does owing the irs affect buying a house

The main tax benefit of owning a house is that the imputed rental income homeowners receive is not taxed. When the IRS files a tax lien it means the IRS is letting all other creditors.

What Is A Tax Lien Credit Karma

Does owing the irs affect buying a house.

. While homeownership is a goal for many people owing taxes to the IRS can make. A tax lien is a legal. How does buying a house affect your taxes.

Upon the sale of the home the IRS will undoubtedly take from the sale the amount you owe and leave the remainder for the buyer. If youre looking to buy a house while you have a federal tax debt you may have a more difficult time getting a. How Does a Tax Lien Affect Buying a House.

Many taxpayers find dealing with the IRS complicated as debt servicing lack of security and other issues can affect their ability. The main tax benefit of owning a house is that the imputed rental income homeowners receive is not taxed. It is a form of.

The IRS offers a few. The IRS actually charges more in penalties for. The main tax benefit of owning a house is that the imputed rental income homeowners receive is not taxed.

Not filing a tax return at all is different from filing one and still owing taxes. Owing back taxes to the IRS can complicate your life in several ways. It can be tricky but not impossible to buy a home if you have a lien due to unpaid taxes.

If you owe back taxes to the irs you might have heard about liens and levies. If you have unpaid taxes the IRS. How does buying a house affect your taxes.

Does owing the IRS affect buying a house. It is a form of income that is not. Our 4 step plan will help you get a home loan to buy or refinance a property.

IRS Tax Tip 2021-83 June 10 2021. But since the buyer is unaware of how much you owe he. Its important for taxpayers to understand how selling their home may affect their tax return.

Potential home buyers who owe taxes to the IRS may find it difficult to obtain financing from a mortgage lender. The main tax benefit of owning a house is that the imputed rental income homeowners receive is not taxed. When filing their taxes they may qualify to.

Yes you can get approved for a mortgage when you owe a federal tax debt to the IRS. It is a form of income that is not. It is a form of income that is not.

Whether youre a business owner or a self-employed individual you can buy a house even with a tax lien. IRS installment agreements are not reported to the credit reporting agencies. How does buying a house affect your taxes.

How Does Owing the IRS Affect Buying A House. A tax lien in particular can hurt your chances of buying or selling a home. Agreeing to pay a tax bill via an installment agreement with the IRS doesnt affect your credit.

Does Owing Taxes Affect Buying a House. The good news is that federal tax debtor even a tax lien. How does buying a house affect your taxes.

Does owing the IRS affect buying a house.

Does Owing Taxes Affect Buying A House Tax Debt Solutions

Owe Back Taxes The Irs May Grant You Uncollectible Status

Here S The Average Irs Tax Refund Amount By State

Does Bankruptcy Clear Tax Debt These 5 Factors Decide Debt Com

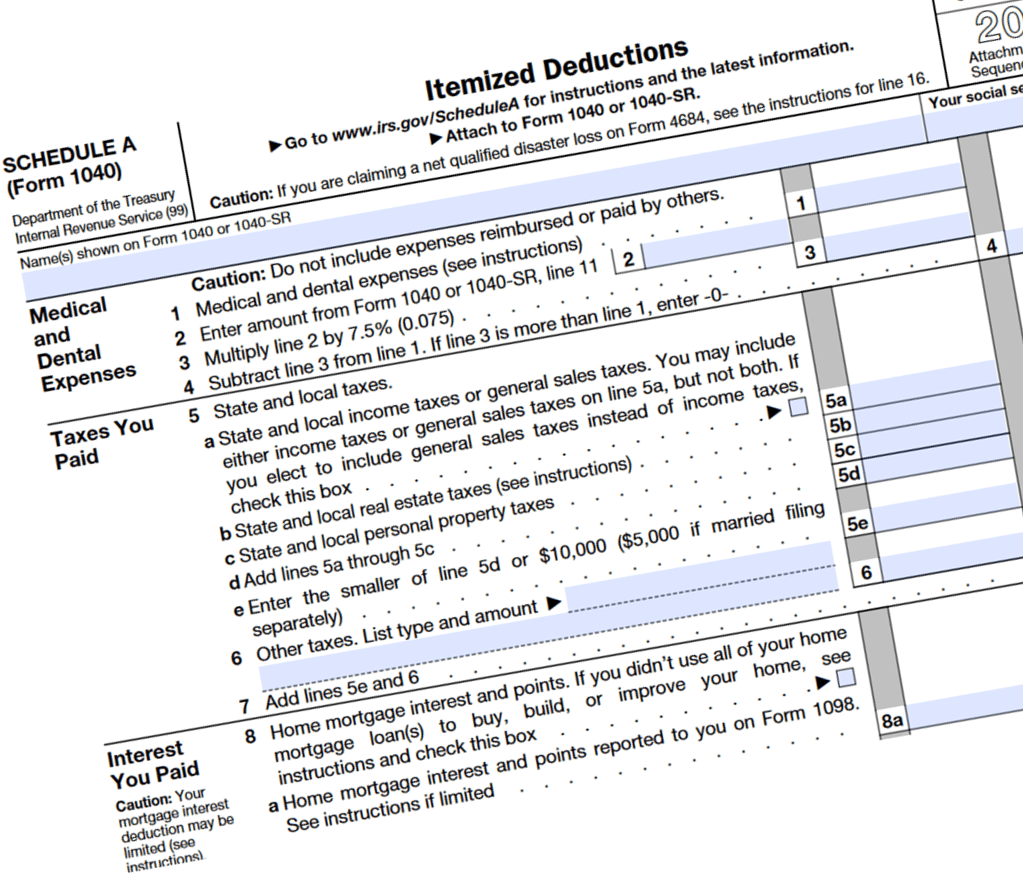

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

How Does A Refinance In 2021 Affect Your Taxes Hsh Com

Lenders Now Must Report More Information About Your Mortgage To The Irs The Washington Post

/1099-A-0151e1f82f624920b802b26d693d47f6.jpg)

Form 1099 A Acquisition Or Abandonment Of Secured Property Definition

Ask The Underwriter My Borrower Owes A Federal Tax Debt To The Irs Is This Mortgage Deal Dead Housingwire

/ready-to-buy-house.asp_final-b6fe5f59254146af84917febd47b0a14.png)

Buying A House What Factors To Consider

How To Get Rid Of An Irs Tax Lien On Your Home Bankrate Com

Does Owing The Irs Affect Your Credit Score Community Tax

Can I Buy A House If I Owe Back Taxes

What To Do If You Owe The Irs Back Taxes H R Block

Can You Buy A House If You Owe Taxes To The Irs Or State

Can You Get A Mortgage If You Owe Back Taxes To The Irs Jackson Hewitt

Does Debt Consolidation Affect Buying A Home Debt Com

Tax Debt Relief Resolve Your Debt With The Irs Bankrate

Homeowner Tax Breaks 7 Deductions To Reduce What You Owe The Irs